Investors, business owners, and community residents have always been interested in Capital Gains Tax in California. The complexities of such taxes become more critical as 2024 approaches in terms of financial preparation and choice-making. State-level capital gains taxes exist in addition to the federal capital gains tax, which is frequently discussed in the media and in political conversations. If you are living in California, you must consult an expert realtor to narrow down the objective of reducing capital gains tax CA. In this ultimate guide, you will learn the critical aspects of boosting your savings by reducing the real estate sale capital gains tax.

Capital gains tax is the amount of profit obtained from selling assets whose financial worth has increased over time. This asset could be your car, house, online trading, inherited property, or anything that can be impacted with the passage of time. To evaluate capital gains tax California, consider subtracting the value of your asset’s price from the total finalized cost. The length of time an investor holds a property before selling it determines how capital gains are handled in certain states. This tax applies to capital gains that have been sold and generate significant income. This tax is only applicable to those capital gains that have been sold and generated income from them. In contrast, if you have an asset such as stocks or real estate property that has not been sold yet but has gained financial worth over time, the California real estate tax will not be applied to it.

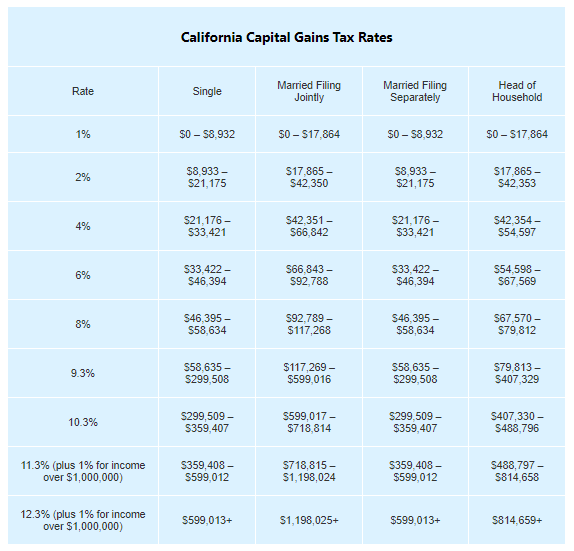

The amount of capital gains tax and income tax is the same for capital gain type of taxes (short-term and long-term) in California. The state applies the same rates of taxes to all the capital gains of the same brackets. In California, the tax rates applicable to income tax and capital gains tax are listed in the table below.

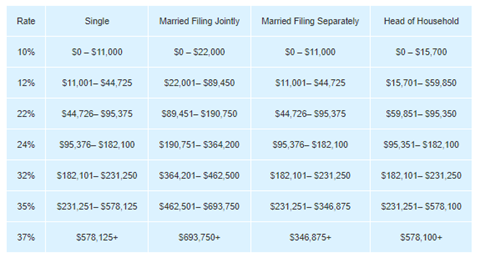

The rate of capital gains for both types of tax, short-term and long-term, is subject to federal taxation. Like any other income tax, short-term capital gains are subject to taxation.

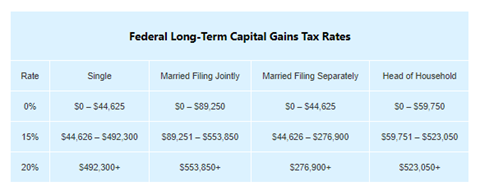

In contrast, the tax on long-term capital gains is either 15%, 20%, or 0% of the gains. The following table highlights the structure of the federal long-term capital gains tax.

The following are a few tricks you may employ to reduce the rates of capital gains taxes you have to pay when you sell an asset.

Neighborhood Home Offer is a proficient option for selling your house and dealing with capital gains tax. They have an expert team of legal advisors to reduce or avoid these taxes while selling your house. Moreover, they help you understand your business and narrow down the details of taxes to avoid them according to the law. Their expert team handles the critical challenges related to capital gains taxes when selling your house. Are you ready to contact them through the website, or by phone to seek expert advice in this daunting task?

In California, regular earnings are subject to a lower tax rate than capital gains. Consequently, any annual income from assets will be applied to the individual’s taxable earnings. Therefore, understanding Capital Gains Tax is crucial for those involved in real estate or investment. Using and implementing these strategies can minimize the tax rate. Moreover, seeking advice from experts can guide you through the process and make selling property more accessible and more profitable. Additionally, planning made after knowing tax rate is vital in navigating capital gains tax effectively.

California capital gains tax is applied to the profit of investors and those in the real estate business from selling their investments. These taxes can be reduced or avoided by holding your assets for over a year or consulting a professional realtor.

California has an efficient property tax rate, with an average rate of up to 0.71%, which is lower than the national average of up to 0.99%. The amount of property taxes is determined by the property's purchase price.

When choosing Neighborhood Home Offer, you will receive expert guidance. They have an expert realtor team to navigate the complexities of capital gains tax to save you money and increase your profits.

Hiring Neighborhood Home Offer will boost your financial margins by carefully overviewing your investment details. They have professional consultants who will guide you through different methods to save money and increase your profits.